With the help of our free demo site, you can run your business or manage your entity.

Registering a business in Bulgaria can open doors to incredible opportunities. The country’s vibrant economy, business-friendly environment, and strategic location make it an ideal destination for entrepreneurs. This comprehensive guide will help you navigate the process of starting a business in Bulgaria, ensuring you are well-prepared to enter the Bulgarian market confidently and make the most of available business opportunities.

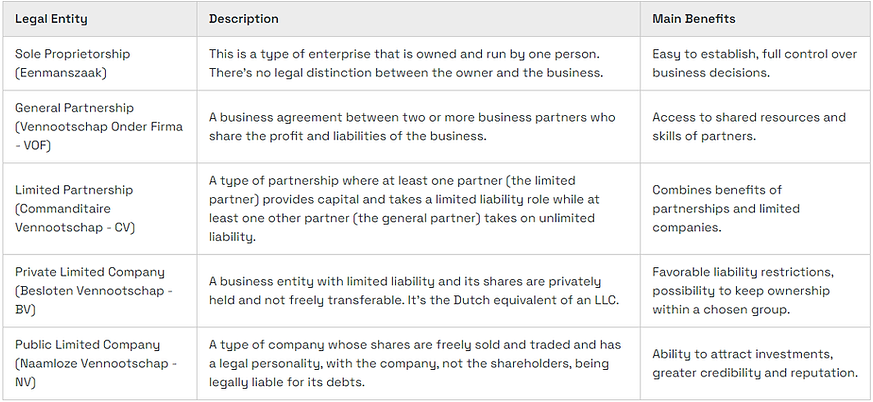

Once you understand the legal requirements, the next step is to decide which type of business structure suits your company best. This decision will greatly influence your company’s future. In Bulgaria, several legal entities are available depending on your needs and goals. Below is an overview of the main types:

Choosing a name for your Bulgarian OOD (Дружество с ограничена отговорност or Limited Liability Company) is a crucial step in establishing your business identity. The name you select will represent your company in all official documents, contracts, and marketing materials. It's essential to choose a name that not only reflects your brand but also complies with Bulgarian legal requirements. Keep in mind that your company name must be unique and not already registered by another business in Bulgaria.

When selecting a name for your Bulgarian OOD, consider using words that are easy to pronounce and remember, both in Bulgarian and English. This is particularly important if you plan to operate internationally. You have the flexibility to use Latin characters, Cyrillic script, or a combination of both. However, remember that the official company name in the Bulgarian Commercial Register will be in Cyrillic. It's also wise to check if the corresponding domain name is available for your online presence.

Before finalizing your OOD's name, it's crucial to verify its availability and compliance with Bulgarian law. The name should not be misleading or confusingly similar to existing trademarks or company names. It's also prohibited to use words that suggest a connection with state institutions or that may be considered offensive. At House of Companies, we can assist you in checking the availability of your chosen name and guide you through the registration process, ensuring that your Bulgarian OOD starts on the right foot with a strong, legally compliant, and marketable name.

Shareholders and capital requirements for Bulgarian OODs (Дружество с ограничена отговорност or Limited Liability Company) are designed to be flexible and accessible, making this business structure attractive for both local and foreign investors. An OOD can be established by one or more individuals or legal entities, with no restrictions on the nationality or residency of the shareholders. This flexibility allows for diverse ownership structures, from sole proprietorships to partnerships and even subsidiaries of foreign companies.

The capital requirements for an OOD in Bulgaria are notably low, contributing to its popularity among entrepreneurs. The minimum required capital is just 2 BGN (approximately 1 EUR), which must be fully subscribed at the time of registration. This minimal capital requirement significantly reduces the financial barrier to entry for starting a business in Bulgaria. However, it's worth noting that while the legal minimum is very low, many businesses choose to start with a higher capital to ensure operational stability and credibility with partners and clients.

Shareholders in a Bulgarian OOD enjoy limited liability protection, meaning their personal assets are shielded from the company's debts and liabilities. Their financial responsibility is limited to the amount of their capital contribution to the company. This protection is a key advantage of the OOD structure. Additionally, the distribution of shares among shareholders is flexible and can be adjusted according to the agreement between the parties. Shareholders have the right to transfer their shares to other shareholders or third parties, subject to the provisions in the company's articles of association. This combination of low capital requirements, limited liability, and ownership flexibility makes the OOD an attractive option for businesses looking to establish a presence in Bulgaria and the broader European Union market.

Opening a business bank account is a crucial step when establishing a Limited Liability Company (OOD) in Bulgaria. A dedicated business bank account helps separate personal and company finances, ensuring clear financial management and simplifying the tracking of income and expenses. It is essential for managing day-to-day transactions, paying suppliers, and receiving payments from customers, which contributes to the overall efficiency and professionalism of the company’s financial operations.

Steps to Open a Business Bank Account

To open a business bank account for your Bulgarian OOD, you will need to gather the required documentation, including the company’s registration certificate from the Bulgarian Commercial Register, the articles of association, and identification documents of the company’s legal representatives. It’s important to choose a reputable bank that offers services aligned with your business needs, such as online banking, multi-currency accounts, and payment processing solutions. Bulgarian banks typically provide specialized accounts for businesses, which help in meeting tax and financial reporting requirements.

Benefits of a Bulgarian Business Bank Account

Having a local business bank account offers several advantages, including easier compliance with Bulgarian financial regulations and tax laws. It also enhances the credibility of your OOD, as local clients and suppliers are more likely to trust a company with a recognized financial presence. Additionally, a business bank account in Bulgaria can offer access to financing options, such as business loans and credit facilities, which can support the growth and expansion of your company. With efficient banking services and robust online platforms, Bulgarian banks can significantly improve your financial management and help streamline business operations.

Limited Liability Protection

Bulgarian OOD (Дружество с ограничена отговорност) shareholders enjoy limited liability protection, which is a fundamental aspect of this business structure. This means that shareholders are generally not personally liable for the company's debts or obligations beyond their invested capital. In the event of company insolvency or legal issues, the shareholders' personal assets are typically protected, limiting their financial risk to the amount they've invested in the company.

Shareholder Rights and Responsibilities

Shareholders in a Bulgarian OOD have specific rights and responsibilities that are outlined in the company's articles of association and governed by Bulgarian commercial law. These rights typically include voting on major company decisions, receiving dividends, and accessing company information. However, shareholders also have the responsibility to act in the best interest of the company and comply with legal and regulatory requirements. This balance of rights and responsibilities provides a framework for shareholder protection while ensuring the company's proper governance.

Legal Recourse and Dispute Resolution

In cases of disputes or conflicts within the company, Bulgarian law provides mechanisms for shareholder protection and dispute resolution. Shareholders have the right to challenge decisions made in violation of the law or the company's articles of association. They can also seek legal recourse through Bulgarian courts if their rights are infringed upon or if there are issues of mismanagement. Additionally, alternative dispute resolution methods, such as mediation or arbitration, may be available depending on the company's internal regulations and agreements between shareholders.

Seamless registration services aim to simplify the process of establishing a business, allowing entrepreneurs to focus on their core activities. These services typically cover a range of essential steps, including business name registration, obtaining necessary licenses, and securing tax identification numbers. By providing a streamlined approach, seamless registration services reduce the complexity often associated with starting a business.

When utilizing seamless registration services, clients can expect personalized assistance tailored to their specific needs. This includes consultations to understand the unique requirements of their business structure, whether it’s a sole proprietorship, partnership, or corporation. Experts will guide clients through the necessary documentation and legal obligations, ensuring compliance with local regulations.

Another key feature of seamless registration services is the use of technology to enhance efficiency. Many providers leverage online platforms that allow clients to submit documents, track progress, and receive notifications in real-time. This digital approach not only speeds up the registration process but also minimizes the chances of errors or omissions that could delay approval.

Additionally, seamless registration services often offer comprehensive packages that include ongoing support beyond initial registration. This may encompass assistance with annual filings, changes in business structure, and updates to licenses or permits. Such ongoing support ensures that businesses remain compliant as they grow and evolve.

Moreover, seamless registration services can provide insights into industry-specific regulations that may affect a business. Understanding these nuances helps entrepreneurs navigate the complexities of their respective markets and avoid potential pitfalls. Access to expert advice can be invaluable in maintaining compliance and promoting sustainable growth.

Finally, seamless registration services foster a positive experience for entrepreneurs by minimizing stress and uncertainty. By handling the administrative burdens associated with business registration, these services enable clients to dedicate their time and resources to building and expanding their businesses effectively, including in countries like Bulgaria.

Fill out the form below to register.

Registering your OOD (Дружество с ограничена отговорност) with the Bulgarian Commercial Register is a crucial step in establishing your business presence in Bulgaria. The process begins with preparing the necessary documentation, which includes the company's articles of association, a list of shareholders, information about the company's management, and proof of paid-in capital. These documents must be drafted in Bulgarian and notarized. It's important to note that while the minimum required capital for an OOD is 2 BGN, it's advisable to consider a higher amount to demonstrate financial stability.

Once your documentation is in order, the next step is to submit your application to the Registry Agency. This can be done either in person at a local registry office or online through the Commercial Register's electronic portal. The online submission process has gained popularity due to its efficiency and convenience. When filing, you'll need to pay the required state fees, which vary depending on the method of submission. The Registry Agency typically processes applications within 3 business days, although expedited services are available for an additional fee.

After your application is processed and approved, your OOD will be officially registered and assigned a Unique Identification Code (UIC). This code serves as your company's tax and social security number. With your registration complete, you can now proceed with other essential steps such as registering for VAT (if applicable), opening a company bank account, and notifying the National Revenue Agency of your company's establishment. Remember that while the registration process can be navigated independently, many entrepreneurs find value in seeking assistance from legal professionals or specialized business service providers to ensure compliance with all Bulgarian regulations and to streamline the process.

Bulgarian employment laws apply to all companies operating within the country, including OODs (Дружество с ограничена отговорност), which is the Bulgarian equivalent of a Dutch BV. These laws are designed to protect employees' rights and ensure fair working conditions. OODs must adhere to the Bulgarian Labor Code, which governs various aspects of employment relationships, including working hours, leave entitlements, minimum wage requirements, and termination procedures.

One of the key areas of compliance for OODs is proper employment contracts. Bulgarian law requires written employment contracts that specify essential terms such as job description, working hours, salary, and notice periods. OODs must register these contracts with the National Revenue Agency within three days of their signing. Additionally, companies are required to maintain accurate payroll records, make social security and health insurance contributions, and provide employees with pay slips detailing their earnings and deductions.

Occupational health and safety is another critical aspect of compliance for OODs in Bulgaria. Companies must ensure a safe working environment, conduct regular risk assessments, and provide necessary safety training to employees. Furthermore, OODs need to be aware of and comply with anti-discrimination laws, data protection regulations (GDPR), and specific provisions for certain categories of workers, such as part-time employees or those on fixed-term contracts. Failure to comply with these employment laws can result in fines, legal action, and damage to the company's reputation, making it essential for OODs to stay informed and implement proper HR practices.

The Bulgarian corporate tax system is characterized by its simplicity and competitive rates. Bulgarian companies and foreign entities operating through a permanent establishment in Bulgaria are subject to a flat corporate income tax rate of 10% on their worldwide income. This rate, which has remained stable for years, positions Bulgaria as one of the countries with the lowest corporate tax burdens in the European Union, making it an attractive destination for foreign investment.

Corporate tax compliance in Bulgaria follows a straightforward process. Companies are required to file their annual tax returns with the local tax authorities, which fall under the Administration of the Bulgarian Ministry of Finance, by the end of March of the following year for the current one. The payment of the corporate tax must also be made within the same period. Advance payments are available and can be made on a monthly or quarterly basis, depending on the company's turnover. It's important to note that Bulgaria does not accept consolidated tax returns, meaning each company needs to file its own return.

The Bulgarian corporate tax system also includes provisions for specific types of income and industries. For instance, a special alternative tax regime applies to the operation of commercial maritime vessels, based on their net tonnage, at a rate of 10%. Additionally, income earned by organizers of certain gambling games is subject to a 15% alternative tax. Bulgaria has also implemented international tax standards, including transfer pricing regulations and participation in global initiatives like the OECD/G20 Base Erosion and Profit Shifting (BEPS) project, to ensure its tax system remains competitive while adhering to international best practices.

Financial Reporting Requirements

Bulgarian OODs (Limited Liability Companies) are required to prepare annual financial statements (AFS) in accordance with the Accounting Act. These statements must provide a true and fair view of the company's financial position, performance, and cash flows. The AFS typically includes a balance sheet, income statement, cash flow statement, and notes to the financial statements. Companies must prepare their AFS by June 30th for the previous financial year, ensuring timely and accurate reporting of their financial activities.

Auditing Obligations

The necessity for an independent financial audit depends on the size and nature of the OOD. Small enterprises are generally exempt from mandatory audits unless they exceed at least two of the following criteria: book value of assets exceeding BGN 2,000,000, net sales revenue over BGN 4,000,000, or an average of 50 or more employees during the reporting period. Medium and large enterprises, as well as public interest entities, are subject to mandatory audits. The auditor is typically appointed by the general meeting of shareholders or the sole owner of the capital, ensuring an objective assessment of the company's financial statements.

Publication and Submission Requirements

OODs are obligated to submit their annual financial statements, along with the annual activity report and audit report (if applicable), to the Bulgarian Commercial Register by September 30th of the year following the reporting period. This publication process is crucial for maintaining transparency and providing stakeholders with access to the company's financial information. Failure to comply with these publication requirements can result in fines ranging from 0.1% to 0.5% of the company's net sales for the relevant financial year. Additionally, companies must register any changes in their articles of association, corporate details, and other significant circumstances with the Commercial Register to ensure up-to-date public records.

The Bulgarian OOD (Дружество с ограничена отговорност), which is similar to the Dutch BV, offers considerable flexibility in structuring, making it an attractive option for entrepreneurs and investors. This business entity type allows for a wide range of customization in its organizational structure, capital requirements, and management setup. The OOD can be established with just one member, making it suitable for sole proprietors, or with multiple shareholders, accommodating various business partnerships and investment structures.

One of the key aspects of the OOD's flexibility lies in its capital requirements and share structure. The minimum required capital for establishing an OOD is relatively low, set at just 2 BGN (approximately 1 EUR), which significantly lowers the barrier to entry for new businesses. Moreover, the OOD allows for different classes of shares with varying rights and obligations, enabling companies to create complex ownership structures that suit their specific needs. This flexibility extends to the distribution of profits, which can be customized in the company's articles of association to reflect the contributions and roles of different shareholders.

The management structure of an OOD also offers considerable flexibility. While the law requires at least one manager, companies have the freedom to appoint multiple managers or establish a management board if desired. This allows for various governance models, from simple structures suitable for small businesses to more complex arrangements for larger enterprises. Additionally, the OOD permits the implementation of specific decision-making processes and veto rights, which can be tailored to protect minority shareholders or to ensure key stakeholders maintain control over critical business decisions. This adaptability in management and decision-making processes makes the OOD a versatile choice for businesses of different sizes and complexities operating in Bulgaria.

Establishing a virtual office address for your Bulgarian OOD (Дружество с ограничена отговорност) can be a game-changing strategy for entrepreneurs looking to expand their business presence in Bulgaria without the overhead of a physical office. This innovative approach allows you to maintain a professional image and meet legal requirements while operating with the flexibility and cost-effectiveness that modern businesses demand. By leveraging a virtual office, you can secure a prestigious business address in key Bulgarian cities like Sofia, Plovdiv, or Varna, enhancing your company's credibility and opening doors to new opportunities in the Bulgarian market.

One of the primary benefits of using a virtual office address for your Bulgarian OOD is the ability to streamline your operations and reduce costs. This solution provides you with essential services such as mail handling, call forwarding, and even access to meeting rooms when needed, all without the long-term commitment and expenses associated with traditional office leases. For global entrepreneurs or those just starting their Bulgarian business journey, this setup offers the perfect balance between establishing a local presence and maintaining operational agility. It's an empowering choice that allows you to focus your resources on growing your business rather than managing office logistics.

However, it's crucial to ensure that your virtual office provider complies with all Bulgarian legal requirements for company registration and operation. When selecting a virtual office service, look for providers who offer comprehensive packages that include not only a business address but also assistance with company formation, tax registration, and ongoing compliance support. This holistic approach will help you navigate the intricacies of Bulgarian business regulations efficiently, ensuring that your OOD remains in good standing while you enjoy the benefits of a flexible, virtual setup. Remember, the right virtual office solution can be a powerful tool in your arsenal, enabling you to establish and grow your Bulgarian OOD with confidence and ease.

Registering a Bulgarian OOD (Obshchestvo s Ogranichena Otgovornost) can be a daunting task, particularly for foreign entrepreneurs navigating the complexities of Bulgarian laws and regulations. Partnering with local experts can significantly streamline this process, ensuring compliance with legal requirements and providing invaluable insights into the Bulgarian market. These professionals facilitate the necessary paperwork, verify documentation, and communicate with local authorities, allowing you to concentrate on launching and growing your business. Their expertise helps to make the registration process faster and more efficient, reducing the risk of costly mistakes or delays.

Consult with Local Experts

Engaging local consultants who specialize in OOD registration is essential for understanding the specific requirements and procedures involved. They will guide you through the initial steps, offering a clear assessment of your business needs and the regulatory landscape. With their local knowledge, they can help you identify potential challenges and provide strategies to address them.

Prepare Necessary Documentation

Local experts will assist you in gathering and preparing the essential documentation required for OOD registration. This typically includes a business plan, shareholder details, and proof of identification. Their familiarity with Bulgarian standards ensures that all paperwork is completed accurately and complies with local regulations, minimizing the chances of delays during the registration process.

Name Selection and Verification

Choosing a suitable name for your OOD is a crucial step. Local professionals can help you select an appropriate name and verify its availability with the Bulgarian Commercial Register to avoid potential conflicts. This service not only saves time but also ensures compliance with naming conventions and regulations.

Draft and Notarize Articles of Association

You will need to work with a Bulgarian notary to draft and notarize the articles of association, as mandated by law. Local consultants can ensure these documents are legally sound and align with your business objectives, facilitating a smoother registration experience.

Open a Bulgarian Bank Account

Establishing a Bulgarian business bank account is an essential step in the registration process. Local experts can assist you in navigating the requirements and paperwork involved in opening an account, ensuring that you can deposit the necessary share capital without unnecessary delays.

Register with the Bulgarian Commercial Register

Once all documentation is ready, your local experts will guide you through the submission process to the Bulgarian Commercial Register. They ensure that all details are accurate and complete, which is vital for preventing any potential registration delays.

Obtain Tax Identification and Compliance

After your OOD is registered, local consultants will assist you in obtaining a Bulgarian VAT number and ensuring compliance with local tax laws. They can provide ongoing support with reporting and compliance requirements, helping you navigate the complexities of the Bulgarian tax system effectively.

By leveraging the expertise of local professionals, you can streamline the registration process for your Bulgarian OOD, paving the way for a successful business venture in Bulgaria.

In the rapidly evolving business landscape, leveraging technology has become essential for streamlining business registration services in Bulgaria. The integration of digital tools not only enhances the efficiency of the registration process but also improves accessibility for entrepreneurs, particularly those unfamiliar with local regulations. By adopting innovative technologies, registration services can simplify complex procedures, minimize paperwork, and reduce processing times, making it easier for businesses to establish themselves in the Bulgarian market.

Digital Platforms for Registration

One of the most significant advancements in business registration in Bulgaria is the implementation of digital platforms that facilitate online applications. Entrepreneurs can now complete their registration forms electronically, upload necessary documents, and submit applications directly through user-friendly interfaces. This shift to digital registration reduces the need for physical visits to government offices, saving time and resources for both businesses and regulatory authorities. Additionally, these platforms often provide real-time tracking of application statuses, enhancing transparency and communication between entrepreneurs and regulatory bodies.

Automated Document Verification

Technology also plays a vital role in automating document verification processes. Advanced systems can quickly validate submitted documents against official databases, significantly reducing the time required for manual checks. This automation minimizes human error and ensures that only accurate and complete applications proceed through the registration process. By streamlining document verification, local authorities can allocate more resources to support businesses and address any potential issues that may arise during registration.

E-signatures and Secure Communication

The use of electronic signatures has transformed the way business documents are executed in Bulgaria. Entrepreneurs can now sign contracts, articles of association, and other necessary paperwork digitally, eliminating the need for physical signatures and in-person meetings. This not only accelerates the registration process but also enhances security by providing encrypted communication channels for sharing sensitive information. By ensuring secure and efficient communication between businesses and regulatory authorities, technology fosters a more reliable registration environment.

Data Analytics for Improved Services

Incorporating data analytics into business registration services allows authorities to gather insights into registration trends, common challenges faced by entrepreneurs, and areas requiring improvement. This data-driven approach enables regulatory bodies to optimize their processes and tailor support services to better meet the needs of businesses. By understanding the specific challenges that new entrepreneurs encounter, authorities can develop targeted resources and guidance, ultimately contributing to a more supportive ecosystem for business growth in Bulgaria.

When establishing a business in Bulgaria, entrepreneurs have several legal structures to choose from, each with its own characteristics, advantages, and disadvantages. The OOD (Obshchestvo s Ogranichena Otgovornost), which is similar to a limited liability company (LLC), is a popular choice among business owners. However, understanding how it compares with other business structures—such as the sole proprietorship (ET), joint-stock company (AD), and general partnership (SD)—is crucial for making an informed decision.

1. OOD (Obshchestvo s Ogranichena Otgovornost)

The OOD is a widely favored business structure in Bulgaria due to its limited liability feature, which protects personal assets from business debts. An OOD can be established by a minimum of one and up to 50 shareholders. The required minimum share capital is relatively low (2 BGN), making it accessible for many entrepreneurs. Additionally, the OOD offers flexible management structures, allowing shareholders to determine the rules of governance. This structure is ideal for small to medium-sized enterprises looking for liability protection and a straightforward operational framework.

2. ET (Edistra Titular) - Sole Proprietorship

The ET is the simplest form of business registration in Bulgaria, suitable for individual entrepreneurs. It requires no minimum capital and involves less bureaucratic red tape. However, the major drawback is that the owner has unlimited liability, meaning personal assets are at risk in the event of business debts. This structure is ideal for freelancers and small business owners who wish to maintain full control over their operations but may not require the liability protection that an OOD offers.

3. AD (Aktsionerno Druzhestvo) - Joint-Stock Company

The AD is a more complex structure, suitable for larger businesses planning to attract significant investment or go public. The required minimum share capital for an AD is higher (50,000 BGN), and it must have at least one shareholder. An AD can issue shares to raise capital, making it an attractive option for businesses with growth ambitions. However, the regulatory requirements for an AD are more stringent, involving regular financial reporting and governance obligations, making it less suitable for smaller enterprises.

4. SD (Sădržno Druzhestvo) - General Partnership

The SD is a partnership where two or more individuals manage the business jointly. Unlike the OOD, partners in an SD have unlimited liability for the company’s debts. While this structure allows for shared decision-making and is easy to set up, the risk involved may deter many entrepreneurs. The SD is generally suitable for small, family-run businesses or professionals in joint practice (like law firms or consultancies) where trust and collaboration are key.

Am I prepared to launch my Entity?

I am prepared to begin trading.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!